A “bad apple” bank “, a group of lawmakers, a group of prosecutors and a former adviser at the State Agency for National Security (DANS) are the owners of big Sofia taxi cab companies, the MP from the civil quota of the right-wing Reformist Bloc, Grozdan Karadzhov, said yesterday (March, 26, 2016) in the studio of Nova TV. He entered into a heated debate with a representative of the taxi cab drivers, who last week surprisingly blocked the key Sofia intersection “Orlov Most” (Eagle’s Bridge), bringing rush hour traffic to a standstill. Their protest was against the new obligation, effective April 1, taxi services to be performed only by carriers who pay taxes and insurance.

“The four major companies in Sofia de facto organized this protest,” said Karadzhov. “Let’s see for whose rights they are lobbying now. One is a bank that is listed in the cables of the US ambassador as one of the “bad apples” in the basket,” Karadzhov said.

“Which owns what? It has interest in this business, right?” asked the host.

“It is the real owner of this company … A bank, which is generously sponsored by the government, is one owner,” Karadzhov replied.

“Nothing is true in his words,” said the representative of the taxi cab drivers in the TV studio.

Bivol correlated the information from the cables of the US ambassador and corporate records and established that Karadzhov is referring to the company “OK Supertrans” whose cars were the most numerous at the protest and that the bank Karadzhov refused to name is First Investment Bank (FIB).

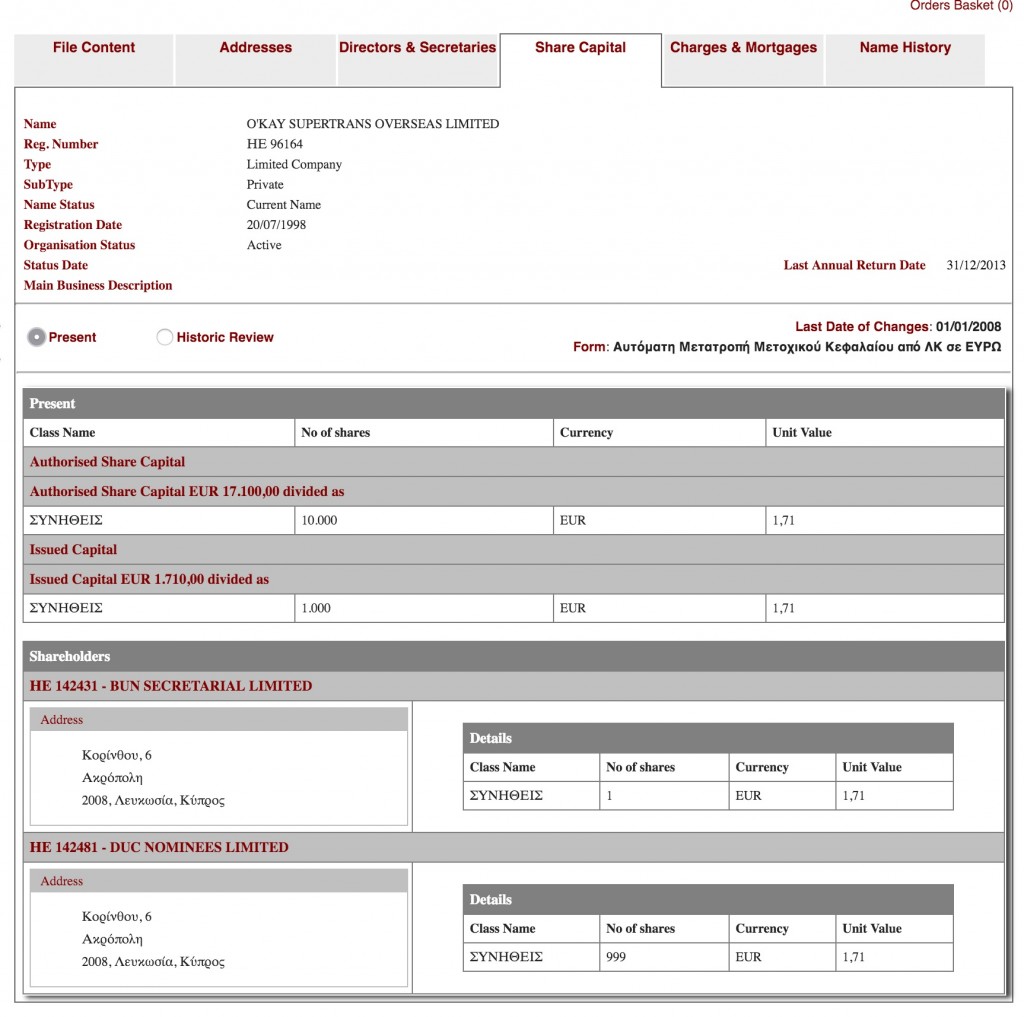

The majority owner of “Okay Supertrans” is a Cypriot company O’KEY SUPERTRANS OVERSEAS LIMITED, which in turn is 99.9% owned by DUC NOMINEES LIMITED. This is emerges from the Cyprus trade register.

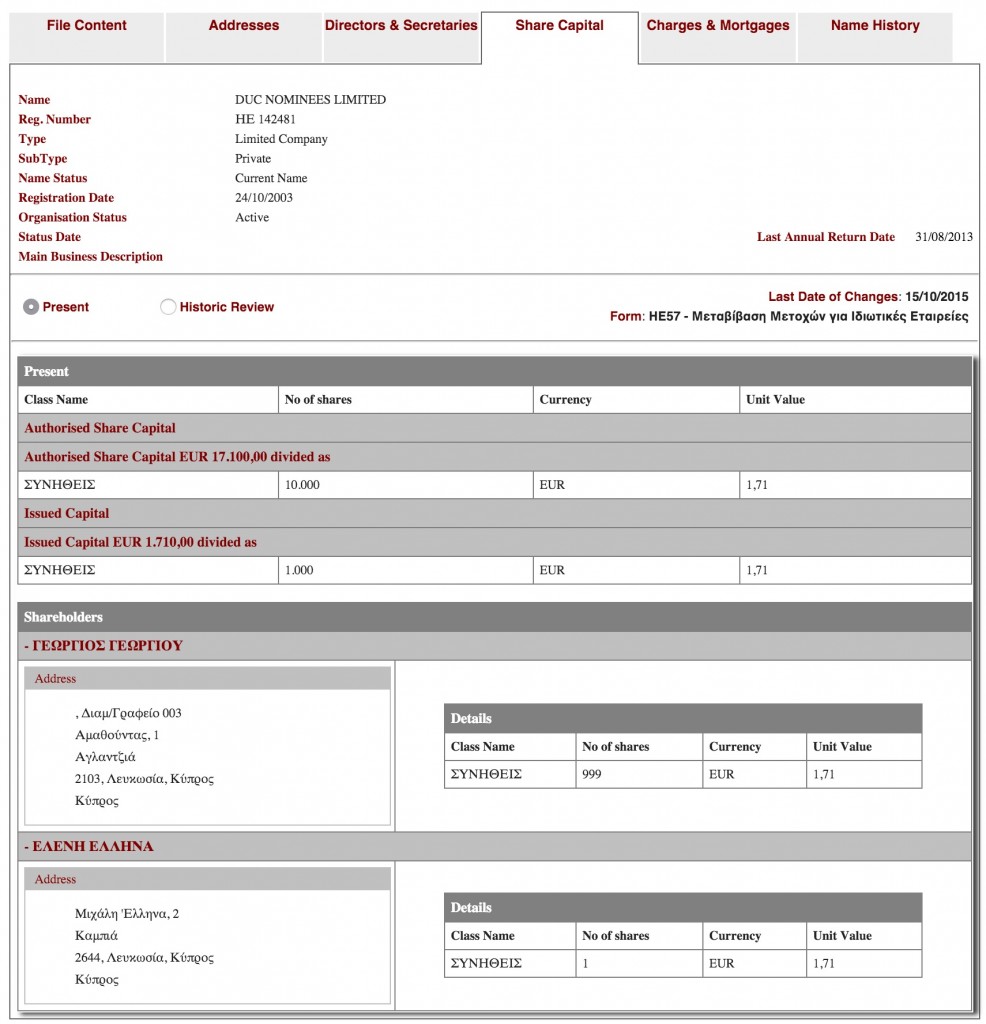

The majority owner of DUC, with 99.9% stake, is the infamous now Georgios Georgiou, who, on paper, is the largest foreign investor in Bulgaria, at least according to the current accounts of the company, which Bivol researched in the Cyprus trade register.

Recently, the venerable investor Georgiou was also recognized by the government which sent him an official invitation to attend the meeting on the future of the Bansko Ski Zone, as the owner of the concessioner, the company “Yulen”. But he did not find the time to honor the meeting, attended by several ministers and lawmakers.

The illegal taxis protest reveals another aspect of the capabilities of Georgiou to influence politics in Bulgaria. To date, he enjoys the political support of individual ministers and advisers in the government, and is defended by dubious NGOs. Georgiou’s business, related to the destruction of Bulgarian nature, also has the fervent support of the media indebted to FIB.

All investments of the Cypriot in Bulgaria were made with loans from FIB, with which he is closely linked. As an investigation of Bivol established, Georgios sold to FIB’s majority shareholders Tseko Minev and Ivaylo Mutafchiev his stake in the bank, owned by another Cypriot offshore company. He also manages the company FRAMAS, a 100% subsidiary of FIB. A detailed list of credits granted to Georgios through dozens of offshore companies can be seen here.

The truth is that Georgios Georgiou is not a multimillionaire, but an unemployed Cypriot national, who serves as a cover for the owners of the bank to siphon depositors’ funds to their personal business projects like “Yulen”, “Vitosha Ski” and hotel business in Bulgaria and abroad.

Bad apples – funneling money for known Bulgarian and foreign criminals in money laundering schemes and involved in connected lending

The illicit funding through connected parties is highlighted in the cable on Bulgarian “bad apples” banks of former US Ambassador in Sofia, John Beyrle, prepared in 2006. It lists eight Bulgarian problematic banks: FIB, Economic and Investment Bank (EIBANK, then owned by Tsvetelina Borislavova, former common-law wife of Sofia mayor and now second-term Prime Minister, Boyko Borisov), Investbank (of Petya Slavova), International Asset Bank (known as the bank of SIC – formerly one of the most influential organized crime groups in Bulgaria), the now-collapsed Corporate Commercial Bank (CCB of Tsvetan Vasilev), DZI (of Emil Kyulev, who was shot and killed in Sofia), Central Cooperative Bank (the bank of TIM) and Sofia Municipal Bank. According to the then-Director of Bulgaria’s Financial Intelligence Agency Dr. Vassil Kirov, these banks deal with “money laundering for Bulgarian and foreign criminals and connected lending”.

Regarding FIB, the classified document, first published by Bivol, says literally the following:

First Investment Bank (FIB) was founded in 1993 by Tseko Minev and Ivailo Mutafchiev with funds of questionable origin. They remain owners, along with two offshore companies from the Cayman Islands and the Channel Islands. The European Bank for Reconstruction and Development (EBRD), an early supporter and investor, recently told us that their participation in FIB is seen as bad spot on EBRD’s record. FIB is now considered to have one foot in the legitimate retail world ) it is known as one of the most aggressive and “polished” banks ) as well as one in the murkier criminal realm.

In 2003, Minev and Mutafchiev bought the Skopje-based Balkan Bank, a.k.a. “the Multigroup bank.” Reportedly, the acquisition saved the Macedonian bank from liquidation and further inspection by the Central Bank authorities. FIB has allegedly extended approximately USD 133 million to shady energy consultant Hristo Kovachki’s Atomremontstroy for its energy projects, as well as to help Kovachki acquire a majority stake in the Sofia Municipal Bank. Minev is reported to own most of Bansko ski resort.

Dr. Vassil Kirov, Director of Bulgaria’s Financial Intelligence Agency, told us recently that in the past two years the FIA has conducted three or four on-site inspections of FIB that resulted in violations. Kirov stated that the bank reported suspicious transactions requiring closer examinations. However, when the FIA began conducting the investigations, FIB refused to provide additional information on the account and account holders. Therefore, FIA had no choice but to fine the bank as a result of noncompliance with banking compliance and secrecy laws. Kirov stated that both Bulgarian citizens and foreign managers ran FIB and that they had suspicious offshore holdings and accounts. Kirov was a little surprised that despite FIB’s reputation, the EBRD was still interested in joint projects with it. He stated that despite the presence of foreign managers and the appearance of foreign investment, most of the money in the bank was private Bulgarian-held capital.

Because of the publication of this document, Bivol was attacked by four banks: FIB, CCB, Investbank and Central Cooperative Bank, which demanded from the central bank (Bulgarian National Bank, BNB) to sanction our media with a huge fine under the Credit Institutions Act. CCB is now dead, and the other “bad apples” are undergoing stress tests that could confirm the trend set by the previous “darling bank of all governments”.

How the European Commission (EC) supported Georgios and Peevski

In the summer of 2014, FIB was rescued from bankruptcy with 1.2 billion levs of public money, while the State refused to help CCB. A few months earlier, the companies associated with controversial lawmaker and media mogul Delian Peevski transferred their loans from CCB to FIB.

EC speedily gave green light to State aid for FIB. Its parameters remained secret, despite serious doubts about benefitting connected parties.

This decision was reaffirmed in November 2014, after new and clear evidence that the bank is not viable emerged, and that it has handed out loans to connected parties in amounts exceeding its equity.

After an investigation of Bivol revealed toxic loans to connected parties, forming a huge capital hole in the bank, EC employee Sophie Bertin-Hadjivelcheva (pictured) left the Commission. She was head of state aid for financial services within the Directorate General for Competition at the European Commission. She was the one who came to Sofia in late 2014 to defend State aid for FIB.

In reality, the Directorate General for Competition at the European Commission actively supported the mafia establishment in Bulgaria, giving a blessing to finance with taxpayers’ money the so-called model #WHO. Its eminent collapse, a sign of which is the de facto bankruptcy of tobacco maker Bulgartabac, will inevitably reverberate in Brussels.

***

If you find this article useful, support our work with a small donation.

Pay a Bivol Tax!

We will highly appreciate if you decide to support us with monthly donations keeping the option Monthly

The form is not published.

IBAN: BG27 ESPY 4004 0065 0626 02

BIC: ESPYBGS1

Титуляр/Account Holder: Bivol EOOD

При проблеми пишете на support [at] bivol [dot] bg

This post is also available in: Bulgarian

You must be logged in to post a comment.