Just one day ago, the Romanian National Anticorruption Department DNA, assisted by OLAF and the Romanian Intelligence, raided the offices of the Romanian Agency for Payments and Intervention in Agriculture (APIA) and arrested several of its former heads. Anti-mafia prosecutors are investigating how and where 26 million euro from the European food aid program for the most deprived has disappeared. The money was taken by a Bulgarian company that vanished without delivering the cooking oil and flour to the poor in Romania. There is an investigation in Bulgaria as well; however, it is idle because the tracks lead to the “sacred cow” of the government – First Investment Bank (FIB). Journalists from Bivol and our Romanian partner Rise Project conducted a several-month-long investigation that definitely proves the connection between the crooks who stole the EU money and the Bank’s owners – Tseko Minev and Ivaylo Mutafchiev.

THE DEAL A deal under a food aid program meant to help deprived persons ended badly for Romania after a government agency concluded two contracts with a Bulgarian company. In 2012, Romania’s Agency for Payments and Intervention in Agriculture (APIA) awarded the contracts to VM Corporation EOOD, registered in Sofia, Bulgaria.

Under the first contract, worth nearly 20 million euros, the Romanian government agency was supposed to receive oil from the Bulgarian company.

The second contract bartered flour for barley. The deal was worth over 6 million euros, but while the Bulgarians got their money and their barley, they never delivered the flour.

The Romanian government agency is now trying to get its money back by executing the bank letters of guarantee the Bulgarian company submitted with its bid. The guaranteed sum amounts to a total of 31.5 million euros.

However, a new obstacle has come up.

Bulgaria’s First Investment Bank (FIB), which issued the letters of guarantee, refuses to make payment saying APIA made payments to a different bank account than the one agreed. The Bulgarian bank says the government agency didn’t transfer the money into the company’s account opened at this bank but somewhere else.

RISE Project and Bivol.bg, the center for investigative journalism in Bulgaria, have found the money went to an account in Cyprus.

THE MONEY HANDLERS On paper, the Bulgarian company is owned and run by Valeri Petrov, a destitute man from Sofia. He should be handling a company that declared in 2011 a net profit of 1.7 million levs from sales. Petrov actually lives on the street which is seen to the left of the photo. When he arrived in FIB to sign bank documents, he caused uproar after parking a horse cart in front of the offices of the Bank, according to eyewitnesses.

Destitute Valeri Petrov, owner and manager of the company that was to deliver cooking oil and flour to all deprived Romanians, lives to the left of this street.

The apartment in the Bulgarian capital that serves as the official registration address for VM Corporation also hosts other companies, connected to one another. Some of these companies are connected to Romanian businesspeople and, further, to the management of First Investment Bank, the Bulgarian private lender that refuses to pay back the Romanian state.

Other companies registered at the same address are connected to Ivan Tanev, the son of a former Bulgarian minister of agriculture. Tanev is wanted via the Interpol for tax evasion and money laundering.

All the companies registered at that address are being investigated by Bulgarian prosecutors for economic crimes.

The investigation team managed to contact Tanev who delivered his version of the story. “We provided goods to APIA for 3 or 4 million euro, according to the deal, but then prices for oil and flour raised and I decided to retract,” he said. “However, Mila Georgieva said she will find and deliver the goods. She took over the contract and I don’t know what happened after that. It’s definitely not my style to take the money and not to fulfill the contract“.

Former Tanev’s associate Mila Georgieva was also charged and Interpol wanted, before being arrested in Serbia, while Tanev disappeared. Actually she is charged by the Bulgarian Prosecution not only for financial crimes, but also as the leader of the Organized Crime Group “The Killers” who committed, according to the Prosecution office, murder attempts, drug trafficking and racketeeng. She is waiting for her process under house arrest. The team couldn’t join her despite many attempts.

In Romania, the European Anti-Fraud Office (OLAF), which monitors EU fund spending, and the National Anticorruption Department (DNA) are probing the deals made by APIA. The money for the two contracts was paid by the Romanian Ministry of Economy, as per procedure under the social program supporting deprived persons, and was to be reimbursed by the European Commission.

SURPRISE CONNECTIONS

[box type=”note” radius=”3″]

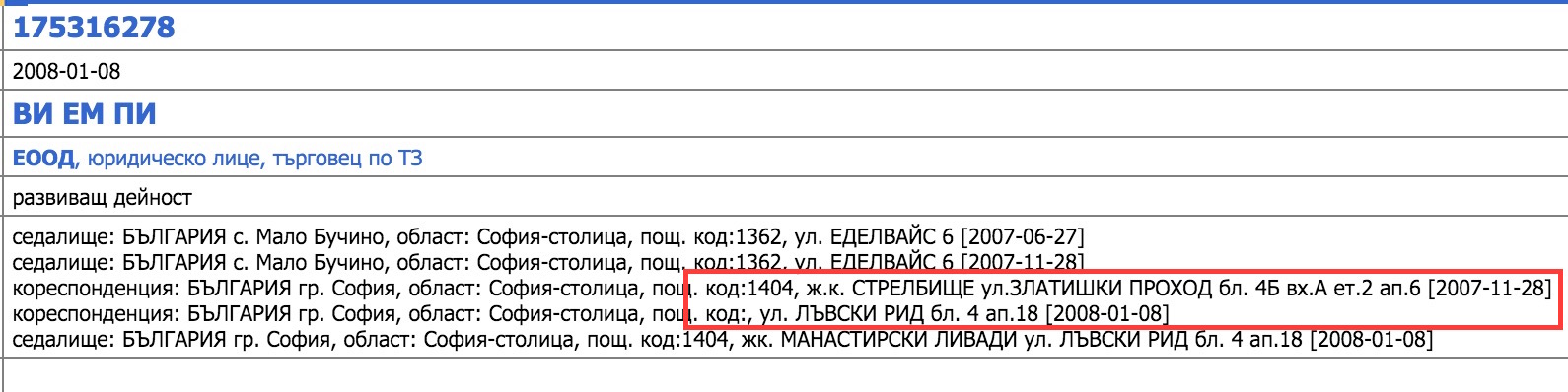

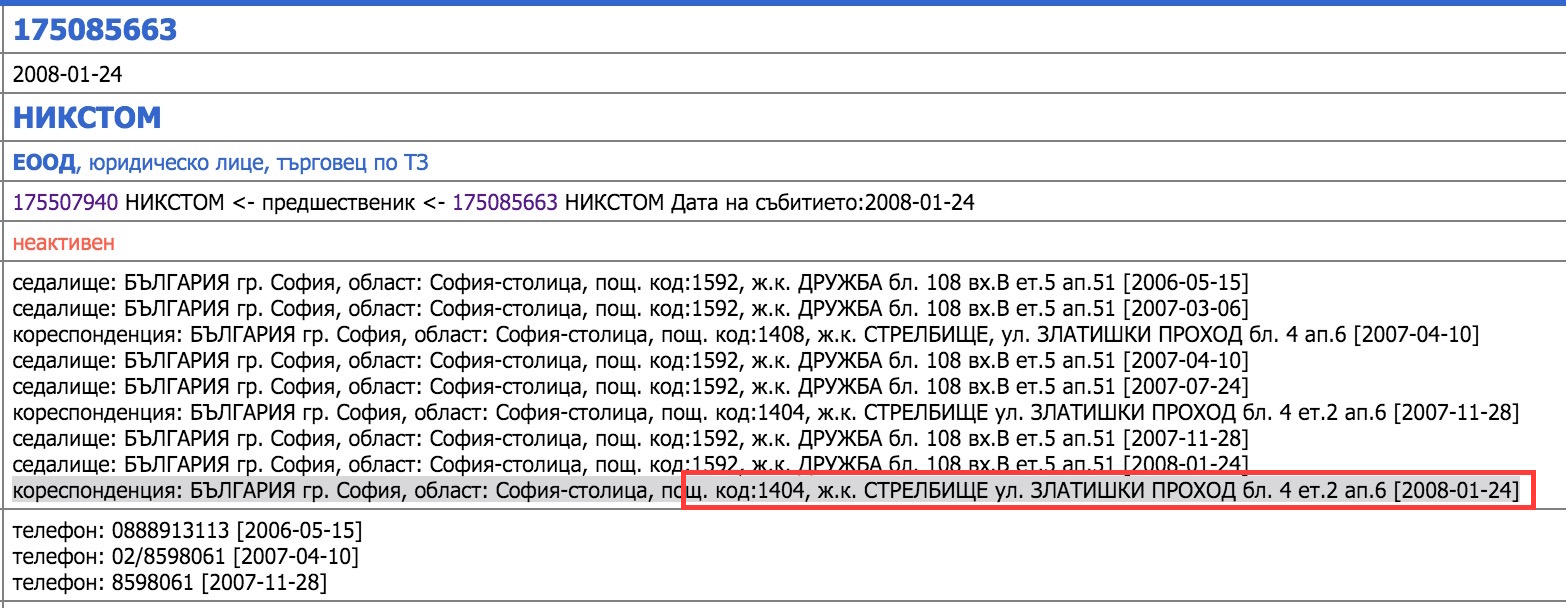

The apartment in Sofia, on 6 Lavski rid street, apt 18, where VM Corporation is registered also hosts other companies connected to one another. All of them indicate as the address for correspondence 4 Zlatishki prohod street, fl. 2 ap. 6. These other companies connect VM Corporation to people in the top management of First Investment Bank through a group of businesspeople in Târgoviște, Romania.

The offshore in the British Virgin Islands, Zalma Holding, is managed by a Romanian citizen, Bogdan Radu Iugulescu. He also serves as manager to another offshore connected to the companies registered in the apartment in Sofia.

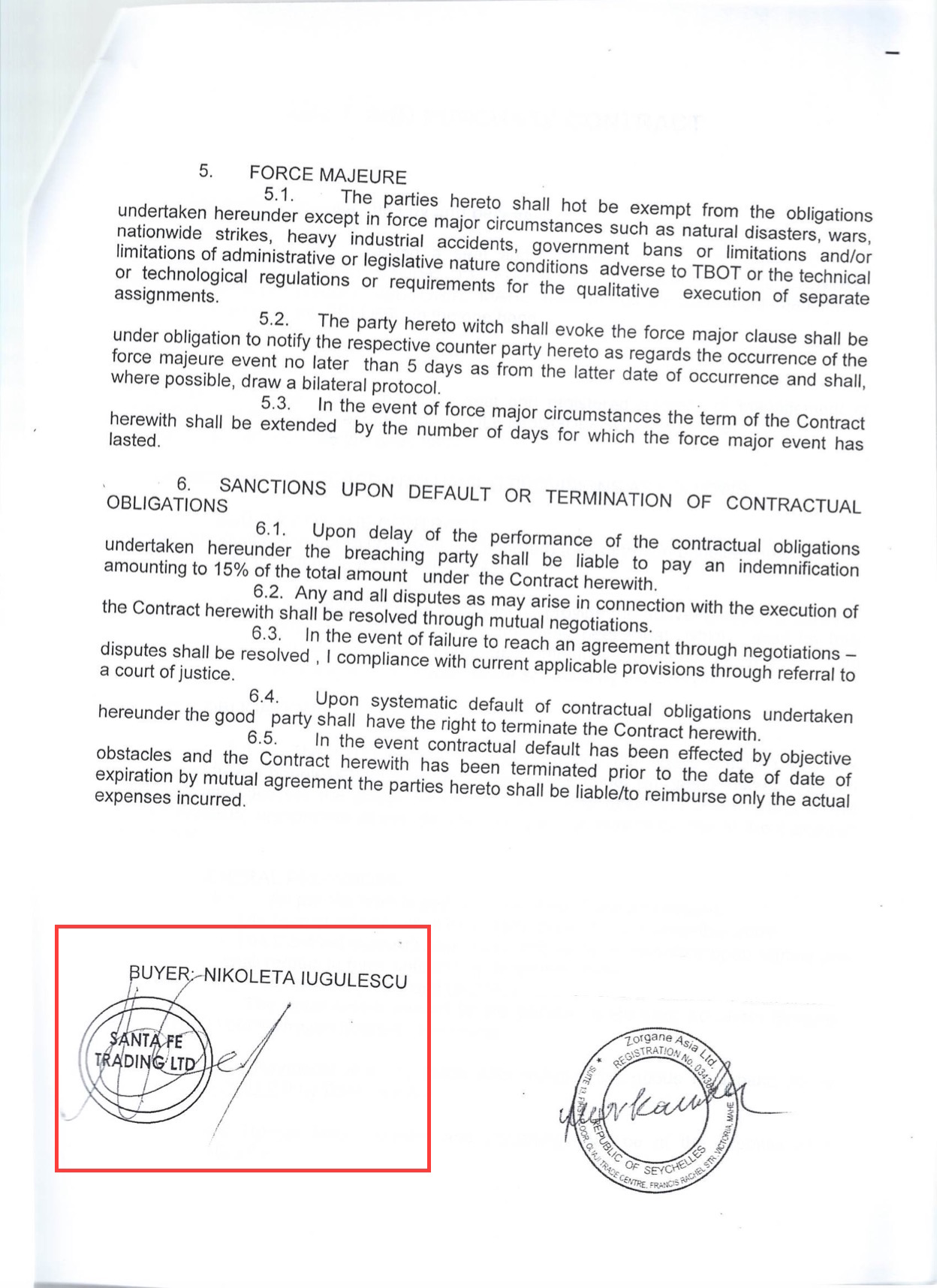

Nixtom EOOD and VMP EOOD, both registered at 6 Lavski rid street, apt 18, vouched for a 16.5 million euro loan taken out by Veilmes EOOD from First Investment Bank. 1 million euros went to Brandel Sent 2000 EOOD, another Bulgarian company (see the full investigation here), and 30,000 euros to Zorgane Asia Limited, a Cypriot company represented by Bogdan Radu Iugulescu’s wife, Nicoleta Iugulescu.

Brandel Sent 2000 EOOD later transferred 2 million euros to Santa Fe Trading, an offshore vehicle registered in Seychelles, whose manager is the same Bogdan Radu Iugulescu.

Bogdan Radu and Nicoleta Iugulescu have businesses in Romania. They are from Târgoviște, Dâmbovița county, where they have a small tire factory, a kindergarten, offer business consultancy services, plus several other companies held together with a group of Italians, operating in the fruit and vegetable sector.

In Bulgaria, Bogdan Radu and Nicoleta Iugulescu’s businesses connect an underworld group whose members are wanted via the Interpol to one of the most influential Bulgarians, the co-owner of First Investment Bank – Ivaylo Mutafchiev.

[/box]

[box type=”note” radius=”3″]

Nicoleta Iugulescu is the representative for Bulgaria of Zorgane Asia Ltd. The offshore owns 100% of Genesis Laboratory, a company that took a 1.3 million euro loan from First Investment Bank. Genesis is also connected to the companies registered in the apartment at 6 Lavski rid street and at 4 Zlatishki prohod street, fl. 2 ap. 6. One of its managers, Ralitsa Vasileva, is also the manager of Nixtom EOOD, registered at the same address.

Ralitsa Vasileva is on the board of directors of Genesis alongside Mila Georgieva, head of “The Killers” underworld clan and a prominent figure in “The Universal” clan. The name of the latter comes from the nickname of Ivan Tanev, clan leader, sought by the Interpol for tax evasion and money laundering.

Ivan Tanev, aka “The Universal”, is a business partner in Sampir Compania EOOD with Petar Skenderov, who in turn owns Veilmes EOOD, one of the companies registered in the same apartment as VM Corporation EOOD.

[/box]

[box type=”note” radius=”3″]Another connection can be traced along the loans from FIB to Elix and Zitera. They are secured by a special escrow account of the associated with FIB company Ski Engineering. The account of Ski Engineering with number 26FINV9150 … 044 was supplied on September 30, 2013 with a transfer from Cyprus for 32.956 million euros. The transfer came from the account CY721160150 … 3,720,001 of the offshore Zalma Trading, which is also managed by Iugulescu.[/box]

[box type=”note” radius=”3″]”Santa Fe Trading Ltd, whose manager is Bogdan Radu Iugulescu, is 100% owned by Evdokia Maklamouzi. The same Maklamouzi owns Mantovaco Limited together with Georgius Georgiu.

Georgius Georgiu is a direct business partner of the two people who control First Investment Bank.

Tseko Minev and Ivaylo Mutafchiev, co-owners of First Investment Bank with a share of 47% each, also own Legnano Enterprises Ltd together, a company whose manager is Georgius Georgiu. Companies nominally owned by Georgius Georgiou and Evdokia Maklamuzi have taken loans from FIB for a total of over 1.2 billion levs, showed a detailed investigation of Bivol (see here).

Radka Mineva, the wife of Tseko Minev, is the manager of another company, Balkan Holidays Services, fully owned by Mantovaco Ltd. Radka Mineva is also the manager of Balkan Holidays Ltd, registered in the UK, and the company’s board of directors includes Georgi Mutafchiev, the brother of First Investment Bank shareholder Ivaylo Mutafchiev.

Balkan Holidays Ltd (UK) received 300,000 euros from Brandel Sent 2000 EOOD, the company that got 1 million euros from the 16.5 million euro loan taken by Veilmes EOOD from First Investment Bank.

The bank’s owners used a financial infrastructure with strong ties to the underworld in Bulgaria, a country often shaken over the last decades by violent clashes between local criminal gangs, to which several bankers have fallen victims.[/box]

Click on the lower right corner of the chart to see it in full screen

FOOD AID FOR THE DEPRIVED

OIL The cooking oil for which APIA paid and which was never delivered was supposed to reach deprived families across the country. The Romanian government paid and the European Union was to reimburse the expense. In total, Romania paid 20 million euros for 17 million liters of cooking oil that was never delivered. The final price was 5.2 lei per liter of cooking oil, whereas the retail price of a liter of oil is around 3 lei.

FLOUR This was not VM Corporation’s first contract with APIA. The company had won a tender for 6.6 million euros back in summer 2012.

At that time, the government agency needed flour for the food aid program and traded barley for it. The barley came from the agriculture paying agencies in Sweden and Germany.

VM was only paid for transport costs and was to receive barley depending on the quality of flour it delivered.

Authorities in Berlin declined to say whether VM picked up their barley, citing ongoing investigations by the anti-fraud office OLAF and anticorruption prosecutors, but their Swedish counterparts said they handed over the barley to a farming association in Sweden after paying VM Corporation.

Under the contract, the Bulgarian company was entitled to sell 70% of the barley from Sweden and Germany without delivering any flour to Romania. That’s nearly 45,000 tons of cereal.

Basically, VM received payment for transport even though it never delivered any flour to Romania and also received payment for the barley it took out from the warehouses of the Swedish agriculture agency.

SHADY TENDERS

The Bulgarian company won the two tenders even though the documents it submitted did not meet requirements. The deal is now under investigation by anticorruption prosecutors and the European anti-fraud office.

* None of the documents submitted for the public procurement tender were originals, only faxes and photocopies even though proper procedure requires original documents or certified copies and notarized translations;

* The Bulgarian company did not have a history in the cooking oil business but in retail;

* The company’s turnover for the previous three years, as declared to Bulgarian tax authorities, was 1 million euros instead of the 10 million euros required in the task book imposed by the EU.

APIA officials declined to comment on the issue citing ongoing investigations by prosecutors.

OFFSHORE ACCOUNT

The money from the contracts ended up in an account in Cyprus.

According to the contracts and the letters of guarantee in the public procurement file, payment was to be made to an account opened by VM Corporation with First Investment Bank in Sofia. But the money went elsewhere.

After VM Corporation won the second tender, APIA received a set of documents sent on behalf of the company by one Stefka Krasimirova Stoeva, a Bulgarian citizen whose name is not mentioned anywhere else in the relation between VM and the Romanian government agency. These documents that changed the method of payment established in the contract. Stoeva is no stranger to doing business with Romania. She owns two construction firms in Bulgaria in association with Romanian citizens, who declined to make any comments regarding her.

In the documents she sent, Stefka Stoeva appeared to be empowered by VM Corporation to inform the Romanian government agency the money was not to be transferred into the company’s account at First Investment Bank but to an offshore account held by VM Corporation in Cyprus.

When asked if he knew who Stefka Stoeva is, Ivan Tanev said he hears this name for the first time in his life. Our team attempted to contact Stoeva and even went to her place. A relative opened the door and said that she’s on a business trip. We left a message for Stoeva who never called back.

The documents sent by Stoeva had different stamps than the ones the Bulgarian company submitted in its bidding file and ended up in a different department of the Romanian government agency, one that has no attributions in public procurement.

One month later, on October 11, the 86 million lei (approximately 20 million euros) for cooking oil left the treasury accounts of APIA and went into a private account the agency opened with Banca Comercială Română (BCR).

The next day, on October 12, the money left this account and went into another account held by APIA at BCR. The government agency opened both accounts on the same day. In this second account, 87.2 million lei was converted into 19 million euros and in less than three hours was transferred to an offshore account in Cyprus, held by VM Corporation EOOD.

Recovery In early 2013, when VM Corporation failed to deliver the flour and the oil, APIA tried to get its money back from First Investment Bank, the lender that vouched for the Bulgarian company at the time of the tenders.

The letters of guarantee issued by the bank covered larger amounts than the company bid. The bank pledged 9.5 million euros in the tender for flour and 22 million euros in the tender for cooking oil. APIA only claimed 28 million euros out of the 31.5 million total.

The Bulgarian bank did not agree to cover the amount for which it had vouched arguing the changing of accounts by Stefka Stoeva a few days before Romania made payment to VM Corporation.

“We note that this document […] appears to be signed by one Stefka Krasimirova Stoeva on behalf of VM Corporation EOOD. The bank was in no way informed by its client regarding Mrs. Stoeva’s right to represent or sign documents on behalf of VM Corporation EOOD,” the bank argued in correspondence with the Romanian government agency.

Moreover, APIA itself allegedly breached its contractual obligations, according to the same correspondence, “by making payment to a different bank account, not open at our bank, disregarding bank account IBAN BG83FINV……..569 stipulated on the first page of the contract.”

“Prudent and diligent behavior should be reasonable from a public authority in its capacity as management authority in charge of funding allocated from the budget of the European Union,” the Bulgarian bank’s legal advisers concluded.

At this time, actions to execute the bank letters of guarantee have been opened both in Romania and Bulgaria but no result has been reached so far.

Is there also a letter of guarantee from “The Universal”?

A publication of the Bulgarian site Mediapool on the same affair claims that the guarantee granted by FIB to the company VM Corporation has been guaranteed by a promissory note from Ivan Tanev and this has been “heavily emphasized in the report of the Bulgarian National Bank – (the central bank, BNB – editor’s note)” on the same loans. They have been granted in an unprecedented violation of all bank lending standards, and in violation of the Credit Institutions Act. Moreover, there have not been reported by the Bank to BNB! Guess why?

Here is what the audit of BNB of these missing credits says: “The experts also found a number of violations in the granting of loans to the other company included in the signal – VM Corporation EOOD, the most striking of which is that BNB has not been notified for the exposure of the loan in breach of the Credit Institutions Act.

“Auditors have established a number of violations in the procedures for approving and granting loans in such amounts. BNB has not been notified for those exposures in breach of the Credit Institutions Act and of Ordinance 7. Again, there is no logical explanation why Ivan Tanev has been attracted as guarantor. According to Article 57 paragraph 1 of the internal rules of the Bank, there is a requirement for valuation of the accepted collateral, which was not done in Ivan Tanev’s case. And in this case, as in the above mentioned, the inspectors have not been provided (over the lack thereof) with an economic justification or a business plan by the borrower”.

The auditors have again established discrepancies between the dates of the request from the client, the opinions of credit experts, the granting decisions of the competent authorities and the contracts. “These findings clearly lead to the conclusion that this customer (rather the guarantor) was privileged by the bank; benefited from its trust, resulting in compromised consistency of the entire credit process, regulated by the internal lending rules,” the BNB report on the case concludes.

The investigation of Bulgarian prosecutors is dragging on, while arrests are already happening in Romania.

Four months ago, Bivol exposed in an investigation, the links between the group of the “The Universal” and Mila Georgieva with FIB. However, Tanev’s signature on the promissory notes may prove to be fake.

Despite the fact he is not in Bulgaria, Ivan Tanev “The Universal” managed to win in court against FIBANK, proving that his signature on bank documents was falsified.

At the time, our publication “Private Lender FIB Is Complicit in the VAT Schemes of Ivan Tanev AKA The Universal” left a teaser for a sequel. The current developments and activities of OLAF and the Romanian authorities are actually the result that we predicted at the beginning of June.

“The bank is trying to put everything on Tanev and they use forged documents,” source close to the affair said under condition of anonymity. “It was the bank itself that opened the different account for VM in Cyprus.” According to the source the whole APIA operation was mounted by Mila Georgieva and Dimitar Kostov, the Executive Director of First Investment Bank.

Serious corruption, involving huge financial abuses and violations, remains undisclosed in Bulgaria. Prosecutors here do not investigate these crimes. Quite to the contrary – the institution subordinate to Chief Prosecutor Sotir Tsatsarov is covering up the tracks of the actual culprits and helps conceal the colossal thefts, some of which are from European taxpayers’ money.

Previous publications on the topic:

Bulgarian Central Bank Refused to Probe Likely Drain of Private Lender FIB

Are Private Lender’s Bonds Draining State Aid?

Greek National Pocketed State Budget Aid Granted to Private Lender FIB

See also: Large exposures to organized crime figures and loans without collateral

* The article has been updated with updated links and documents on October 6, 2015

***

If you find this article useful, support our work with a small donation.

Pay a Bivol Tax!

We will highly appreciate if you decide to support us with monthly donations keeping the option Monthly

The form is not published.

IBAN: BG27 ESPY 4004 0065 0626 02

BIC: ESPYBGS1

Титуляр/Account Holder: Bivol EOOD

При проблеми пишете на support [at] bivol [dot] bg

This post is also available in: Bulgarian

You must be logged in to post a comment.