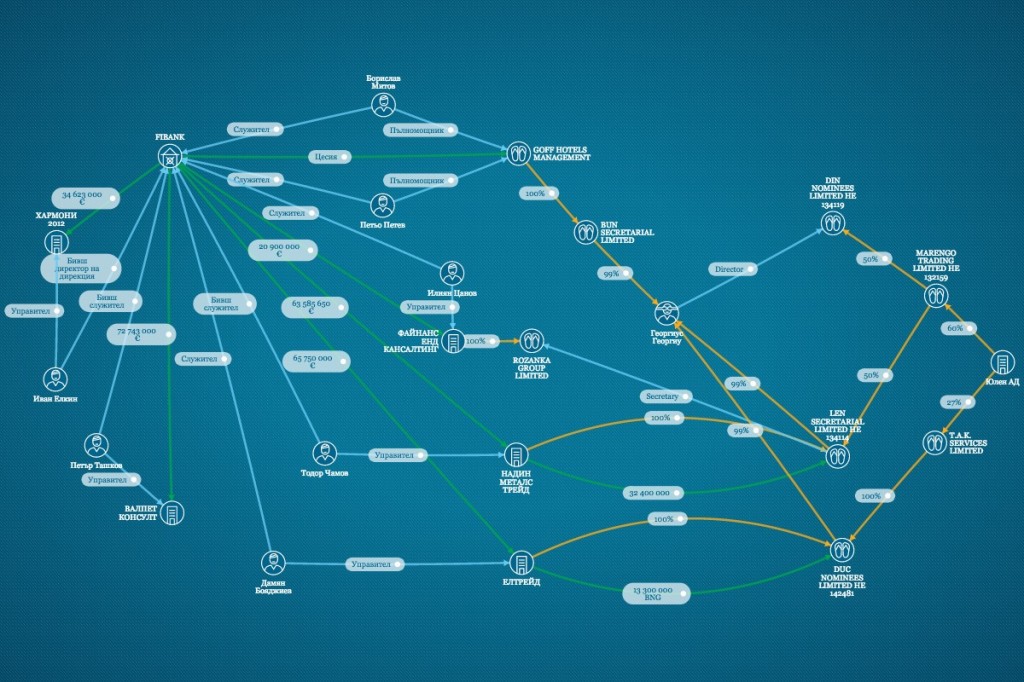

Damyan Boyadzhiev, Borislav Mitov and Ilyan Tsanov are reputable professionals in the financial sector. What connects them is that they all work for Bulgarian private lender First Investment Bank (FIB). But not only that… Besides being FIB employees, they are the managers and representatives of offshore companies in Cyprus and the British Virgin Islands. Some of these companies have huge, repeatedly-renegotiated loans from FIB. Others have acquired loans from FIB through contracts for assignment of receivables. These circumstances position the said persons (actually FIB) on both ends of the financial transactions. However, the central bank (Bulgarian National Bank, BNB) refuses to acknowledge that connected parties exist.

Article 45 of the Credit Institutions Act (CIA) defines what are parties connected with a bank. These are administrators, shareholders, their relatives, companies managed by them. But the law also mentions “third parties acting on behalf of the persons” listed above. Exposure to such a person may not exceed 10% of the bank’s capital and the total amount of all formed exposures of the bank to these persons may not exceed 20% of its equity.

According to public data, published by Bivol, several offshore companies, including those managed by former and current employees of the FIB, have received a total of 550 million levs in loans. This represents 76% of FIB’s capital, which by September 30, 2014, was 719.6 million levs.

Loan amounting to 23% of the capital of FIB to offshore companies managed by its employees

How many exposures are there to companies managed by current employees of FIB? We are interested in persons about whom it can definitely be argued that they currently fall under the definition of “connected parties”. They are under economic dependency from FIB and shareholders and FIB’s management can exercise control over them.

The biggest exposure is of ELTRADE COMPANY, managed by Damian Veskov Boyadzhiev, who is a credit appraiser at FIB. This company has two loans totaling 65,750,000 euro or 128,595,823 levs. This amount represents approximately 18% of FIB’s capital, which already exceeds the legal limit.

FINANCES AND CONSULTING company, with manager Ilyan Bozhidarov Tsanov, who is also a current employee of FIB, has received two loans totaling 20,900,000 euro or 40,876,847 levs. Although it operates with tens of millions of levs, this company has all in all one employee, according to the records of the Social Security Institute.

One the base of the above facts, it can be estimated that the total exposition of FIB to directly and provably connected parties is 169,472,670 levs or nearly 23% of the capital, which is a violation of the law.

The give-away money is swelling

VALPET CONSULT, with manager Peter Tashkov, a former employee in the Corporate Lending department of FIB, has loans in the amount of 72,743,000 euro or 142,272,942 levs; NADINE METALS TRADE with manager Todor Petrov Chamov, also a former employee in the Corporate Lending department of FIB, has taken loans in the amount of 63,585,650 euro or 124,362,722 levs. HARMONY 2012, managed by Ivan Lyubomirov Elkin, former Department Director in FIB and a former branch manager in the town of Harmanli, has loans in the amount of 34,623,000 euro or 67,716,702 levs. On this backdrop, HEFTY METALS LTD, whose manager, Eftim Stoychev Ormanov, is a long-time employee of FIB and former Director of the Liquidity department of FIB, has the modest loan of 7 million euro or 13,690,810 levs. The total amount of these loans is 348,043,176 levs or nearly 48% of FIB’s capital.

These data on connectivity were provided to BNB for examination, before being published. The supervisor answered the following:

“It should be specified that the current European regulations for acceptable concentrations of credit risk are covered by Regulation 575/2013/EU on prudential requirements for credit institutions and investment firms and under it not any type of connectivity (even less suspicion of such) is relevant, but only the existence of “a group of connected clients, within the meaning of Art. 4 § 1, item 39 of the Regulation, where cases in which the presence of certain persons or companies can be treated as forming such a group are clearly outlined.”

It is unclear why the central bank is referring to the EU Regulation, and not the current Bulgarian Credit Institutions ACT (CIA). According to financial experts, the answer is not correct because there is no question about connectivity between clients of FIB, but about connected parties between FIB itself and its clients within the meaning of Art. 4 § 1, item 38 of the Regulation, which is definite:

‘close links’ means a situation in which two or more natural or legal persons are linked in any of the following ways:

- c) a permanent link of both or all of them to the same

Strange assignment of credits to “closely connected” offshore company

In the investigation in connected companies-borrowers, Bivol found evidence that they operate at a loss. At the same time and in turn, these losing companies, credited with many millions by FIB, provide huge loans to parent companies registered in foreign offshore jurisdictions. Quite legitimately, the question arises whether FIB is being drained through this?

Bivol discovered another strange operation of FIB – assignment of credit for tens of millions to the connected offshore company GOFF HOTELS MANAGEMENT, registered in the British Virgin Islands.

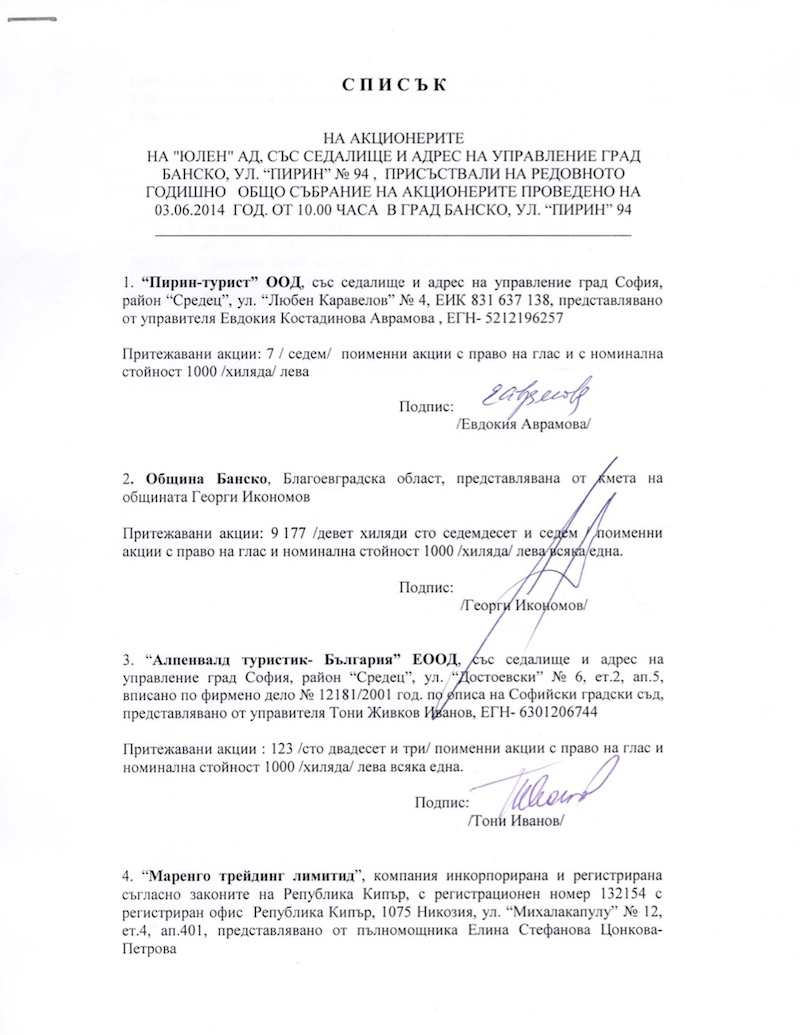

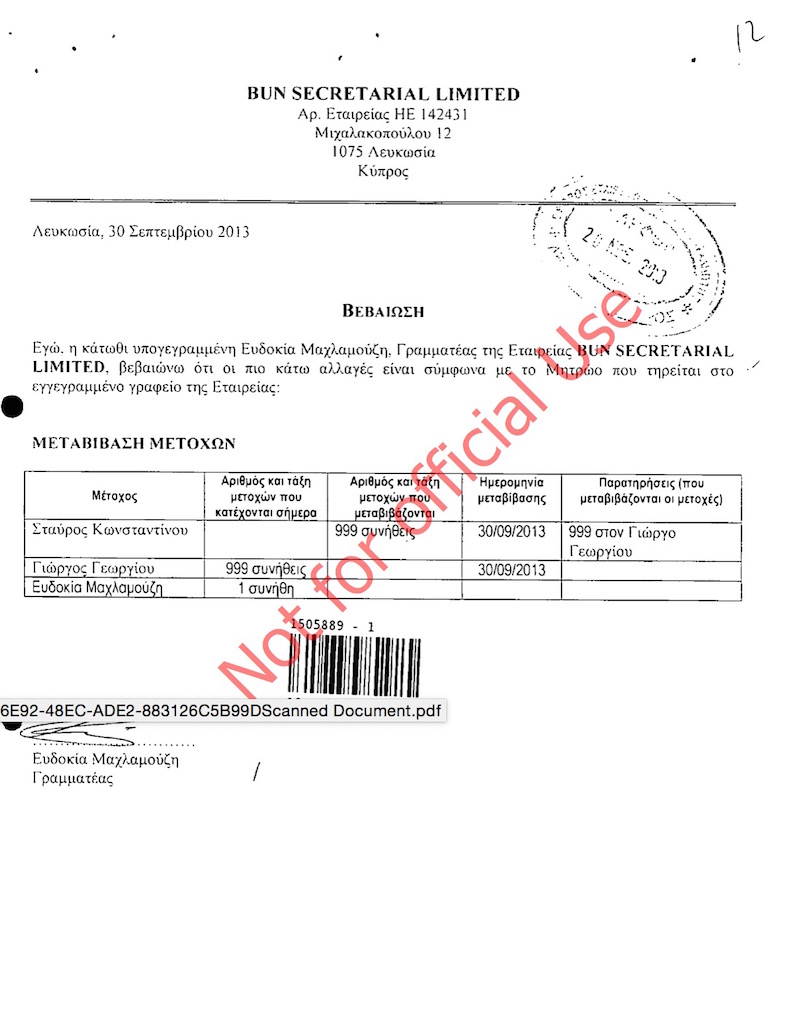

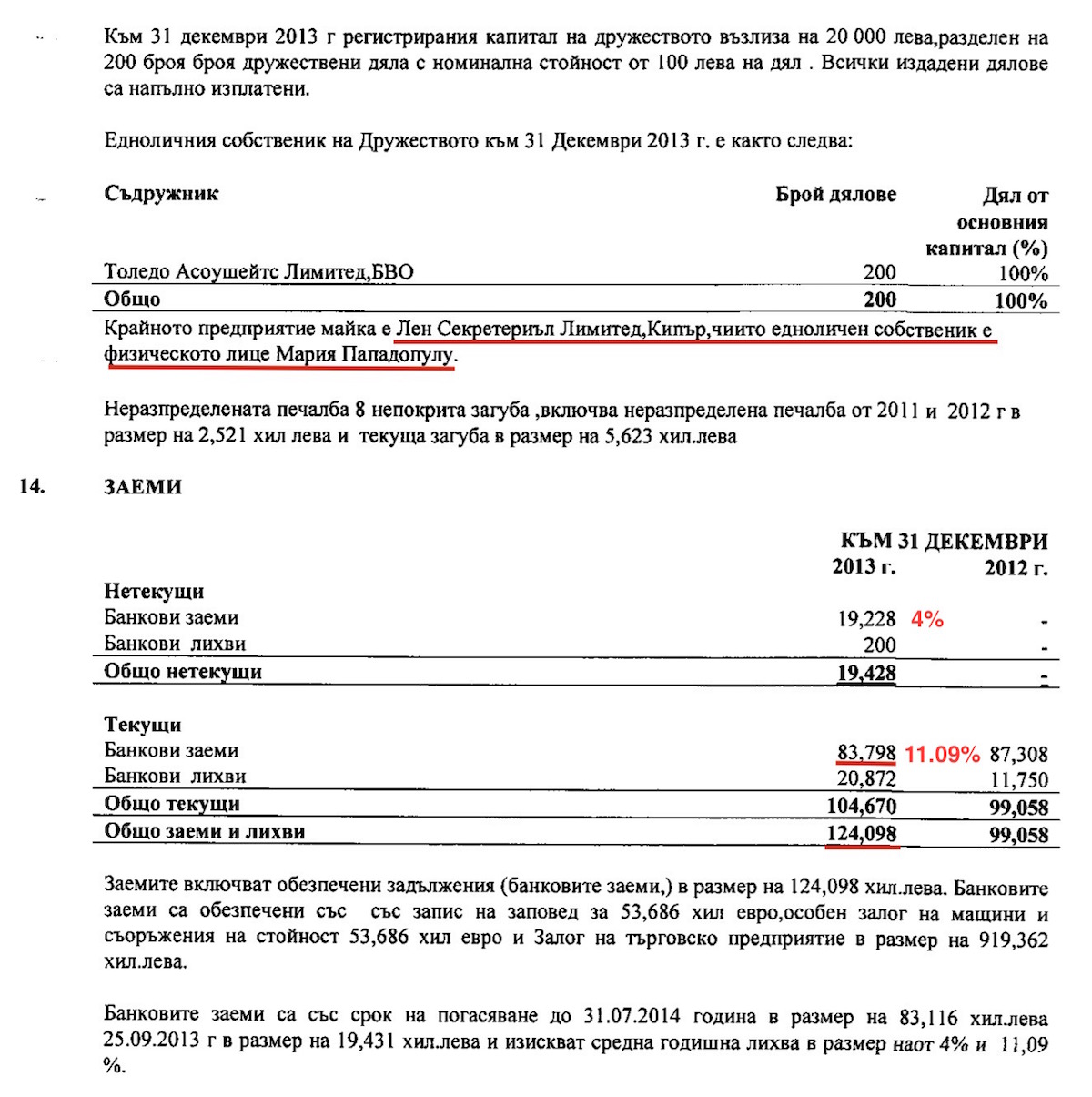

GOFF HOTELS MANAGEMENT belongs to Bun SECRETARIAL LIMITED whose owner is individual Georgios Georgiou. The same man is behind numerous offshore companies operating in Bulgaria. Georgios Georgiou is also the owner and director of DIN NOMINEES and LEN SECRETARIAL which are owners of Marengo TRADING LIMITED Cyprus. The latter is the majority owner with 60.71% of the capital of the notorious YULEN that felled and built illegally in parts of Pirin National Park. Georgiou, however, is also the owner, through another offshore company – DUC NOMINEES – of T.A.K. SERVICES LIMITED Virgin Islands, which have 27.12% stake in YULEN. Thus, the joint property of these intriguing companies, connected to certain persons, totals 87.83% of the capital of the famous owner of the ski facilities in Bansko – YULEN. Documents from the Cyprus Trade Register show that Georgiou has acquired ownership of four companies BUN, LEN, DIN and DUC on the same day – September 30, 2013

On the other hand, LEN SECRETARIAL and DUC NOMINEES are declared as final owners ELTRADE and NADINE METALS TRADE, which received huge loans from FIB, and in turn lent to parent offshores which in turn own YULEN. LEN SECRETARIAL is also the secretary of the offshore company behind FINANCES AND CONSULTING, mentioned above. That is not all, and Bivol will publish a separate investigation in the branches of this chain and how far they go in their connectivity with FIB. For now you can judge the level of connectivity through the diagram below (click on the image to open it in a higher resolution).

On September 26, 2013, FIB assigned to GOFF HOTELS MANAGEMENT its receivables from INTERTRUST HOLDING JSC under a credit agreement from March 31, 2006. The amount of the assignment is 3,335, 441.59 euro. Then, GOFF’s representative was Petio Petev, who is an employee of FIB. (https://www.facebook.com/petyo.petev.5)

On September 15, 2014, FIB signed another contract of assignment with GOFF HOTELS MANAGEMENT, this time for a debt of 35 million euro of BURGAS SUGAR PLANTS JSC that had arrears in payment. The offshore company acquired the remaining debt of 13,337,664.23 euro. GOFF’s representative for this assignment was Borislav Emilov Mitov, who is an employee of FIB and is announcing it proudly on social networks (https://www.facebook.com/borislav.e.mitov/photos_albums).

Кредит от 35 млн. евро е цедиран от ПИБ на офшорка управлявана от неин служител след като е станал предсрочно изискуем.

What is the reason for this maneuvering with the assignments? Is there an actual transfer of money or are these fictitious accounting operations to reduce the bad exposures of FIB? Why is FIB forsaking collecting its money that it has taken from depositors to lend to losing business, and is instead transferring them to an obviously connected company with unclear owner? And could this be another way to drain a lot of money? Are all these assignments appropriate and are they protecting the interests of the banks as a credit institution?

The tracing of the schemes of connected parties and companies around GOFF, which ultimately lead directly to FIB, leads to the assumption that the assignments are made to officially relieve borrowers from the many millions in obligations to the Bulgarian bank and for them to remain indebted to a subject which can be directly linked to its majority owners.

#Who will supervise and oversee our banking system

As we learned from our intense correspondence with BNB, its supervisory unit adamantly refuses to check data on loans of FIB to connected parties, which are in clear violation of the law. This raises the legitimate question – who is BNB serving and whether its total failure in the collapse of private lender Corporate Commercial Bank (KTB or CCB) was random or is this a well-oiled corruption scheme to conceal financial crimes inflicting severe and lasting damage on national level? Therefore, all data on suspicious financial activities in the banking sector and on suspicious assignments have been summarized in a special signal to the prosecution. Not that we expect anything exceptional from this discredited institution, but at least we are fulfilling our journalistic and civic duty to submit the required information.

Bivol defends the cause of preventing a second severe bank collapse, because it will be really fatal for the State. If the institutions in charge do their job as required by law and do not collaborate with the Mafia, this can be avoided. However, the real situation shows that this is not the case, the problems deepen and the tragedy becomes more and more obvious to outside observers and investors.

***

If you find this article useful, support our work with a small donation.

Pay a Bivol Tax!

We will highly appreciate if you decide to support us with monthly donations keeping the option Monthly

The form is not published.

IBAN: BG27 ESPY 4004 0065 0626 02

BIC: ESPYBGS1

Титуляр/Account Holder: Bivol EOOD

При проблеми пишете на support [at] bivol [dot] bg

This post is also available in: Bulgarian

You must be logged in to post a comment.