An investigation of Bivol found the same symptoms in the private lender First Investment Bank (FIB) that led to the drain and the collapse of another private lender – Corporate Commercial Bank (CCB or KTB) – doubtful securitization of loans, uncollectable loans, loans by borrowers to offshore companies, lending to connected parties, to fictitious companies and to employees.

A lot has been already written in some media about what is cooking in FIB regarding lending to connected parties and prosecutors’ investigations in loans granted “without basic verification”, but a closer look at the loan portfolio of FIB reveals very specific evidence about draining through connected companies.

The Cannonball “Kremikovtzi»

On April 12, 2011, the unknown to anyone, but enterprising young college student Lachezar Varnadzhiev, owner of the newly created company ELTRADE, paid 316 million levs for the remnants of the mastodon socialist steel-mill Kremikovtzi. He purchased it with loans from FIB.

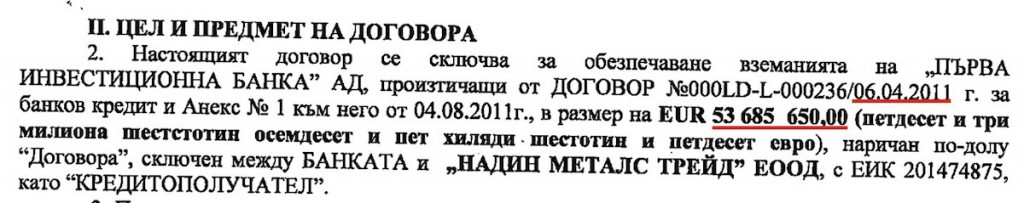

Only a few days earlier, on April 6, 2011, FIB has granted loans to three start-ups: NADINE METALS TRADE – 53,685,650 euro, ELTRADE COMPANY – 59 million euro and VALPET CONSULT – 56,243, 000 euro. The deadline for repayment of the loans was July 31.2014 (i.e. it has already expired). After receiving the loans and buying Kremikovtzi, the original owners of the companies transferred them to offshores and FIB’s trusted individuals and some of its former executives were appointed managers.

Who are they and what is the scheme will be further revealed in the course of our investigation.

The repayment schedule of the loans is unknown, however, the 2013 annual financial statements of the three companies show what the outstanding due amounts by December 2013. NADINE METALS TRADE owed 42.8 million euro in principal and 10.6 million euro in interest; VALPET – 43.5 million euro in principal and 11.9 million euro in interest ELTRADE – 51.8 million euro in principal and 15.3 million euro in interest. The total is 175.9 million euro.

FIB officially assured the public that it assessed the risk of financing these obscure companies and that it estimated that the money for the purchase of the steel-mill will be returned at a profit.

What happened seven months later, on July 31, 2014, the term of the final repayment of the loans? The companies were at a loss and there was no way for them to recover the loans (ELTRADE had even sunk with a commercial loan to an unknown person for 97 million levs).

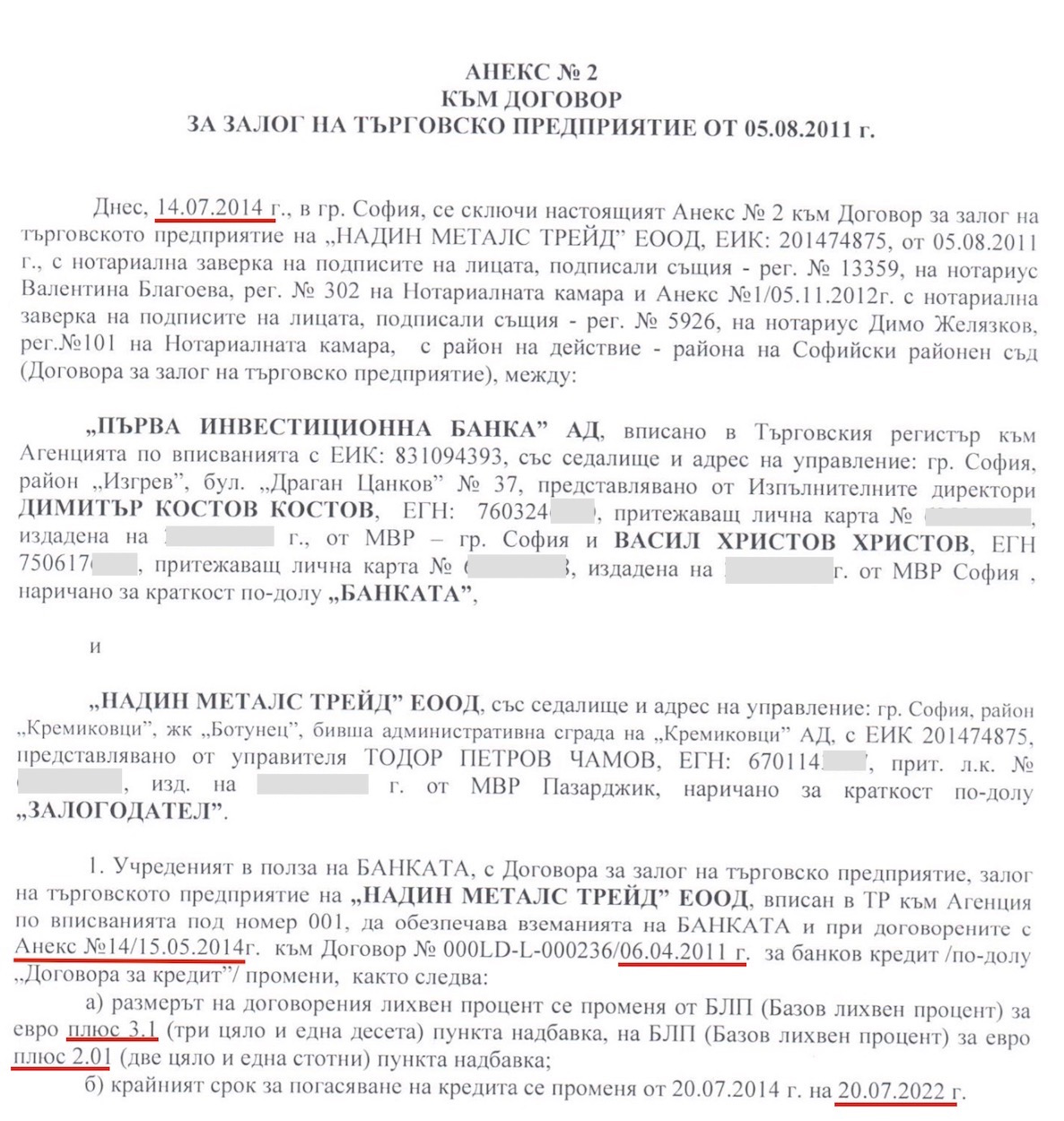

A huge capital hole was to open. However, a month and a half before the deadline – on May 15, 2014, the three loans were renegotiated with a new 2022 term trough an annex, the 14th in a row!

По този начин огромните кредити не се вписват в графа “лоши”. Като бонус дори им е намалена лихвата.

Thus, the huge loans were not listed as “bad” ones. As a bonus, their interest rate was even reduced.

A month and a half after these renegotiations, anxious customers of FIB began to massively withdraw their deposits. On June 29, FIB was rescued with a powerful injection of government money. Then all the factors in the State unanimously argued that FIB’s problem was not a capital one, but of purely liquidity. The European Commission authorized the State aid, but requested to receive within two months a plan for the restructuring of the bank.

What would have happened if the truth about the non-recovery of some 340 million levs, which is nearly 40% of the bank’s capital, was revealed then? It turns out that these loans are simply not being serviced; the penalty interest already surpassed the principal, however, this is concealed every two-three months through annex after an annex. This way the loans appear provisioned and serviced and their inevitable maturity is delayed hypothetically in time, and even with renegotiation of more favorable conditions.

At the time of the rescue of the bank all this was not known. Collateral agreements, making the renegotiation of loans public, were concluded only on July 14, 2014, and registered on August 8. This happened more than a month after FIB was rescued with 1.2 billion levs from the State budget.

Amounts are swelling

Besides repeated renegotiations of their first loans, the same companies used additional funding from FIB at the “preferential” rate of 4%. On one same date – September 25, 2013 – and under the same conditions – loan maturity on September 25, 2033, NADINE METALS TRADE has taken a loan of 9.9 million euro, ELTRADE COMPANY – 6.75 million euro, and VALPET CONSULT – 16.5 million euro. This way, the total exposure of FIB only to these three companies exceeded the impressive amount of 200 million euro.

Педантичното проследяване на заемите сключени от другите фирми от съзвездието НАДИН (НАДИН-Н АД, НАДИН РИЪЛ ЕСТЕЙТ ЕООД, НАДИН ХОЛД ЕООД, ХЕФТИ МЕТАЛС) добавя към тази сума още 15 000 000 евро кредит към офшорката ФРИЙЖЪН КОНСАЛТАНТС и 7 000 000 към НИКИЛА ДИВЕЛОПМЪНТС.

или общо над 220 млн. евро експозиции на банката към фирми за скрап, разпродаващи старото желязо на Кремиковци.

Само от тази информация за кредитите около фирмите в сделката «Кремиковци» възникват следните въпроси:

– редовни ли са кредитите или се предоговарят от анекс до анекс, за да изглеждат редовни?

– могат ли да служат за обезпечения машините и желязото от нефункциониращото предприятия Кремиковци?

– ще бъде ли признато рефинансирането им по новите стандарти за счетоводство – ИАС 39 и IFRS 9, който бе приложен към КТБ?

Особено важен за обществото е отговорът на въпроса: какво ще се случи ако тези кредити в крайна сметка се окажат лоши и не се върнат в банката? Според ситуацията с фалиралата КТБ може да се предположи, че ще ги платят хората с депозити и данъкоплатците, които наляха един милиард лева за спасяване на ПИБ.

Биволъ откри и други детайли, от които освен БНБ трябва да се интересуват прокуратурата и ДАНС. Те са свързани със съмнения като

Източване към офшорки

Дотук схемата наподобява подозрително на случилото се в КТБ – кредитиране на офшорни собственици, зад които не се знае кой стои, но може да са и самите акционери на банката. Заемите не се изплащат, а просрочията се прикриват с предоговаряне.

A meticulous tracking of loans granted to other companies in the NADINE “constellation” (NADINE-H JSC, NADINE REAL ESTATE LTD, NADINE HOLD LTD, HEFTY METALS) added to that amount a 15-million euro loan to the offshore company FINANCES CONSULTANTS and 7 million euro to NIKITA DEVELOPMENTS.

This is a total of over 220 million euros of exposures of the bank to companies for scrap, selling Kremikovtzi’s scrap metal.

Just this information about loans to companies in the deal Kremikovtzi raises the following questions:

– Are these “good” loans or are they renegotiated from annex to annex in order to appear in order?

– Can the machinery and the iron from the closed Kremikovtzi be used as collateral?

– Will their refinancing be done under the new accounting standards – IAS 39 and IFRS 9, which were applied to KTB?

The answer to the question what would happen if these loans ultimately prove bad and end up not being repaid to the bank is especially important for society. Judging by the situation in the bankrupt KTB, it can be assumed that they will be paid by people with deposits in FIB and by taxpayers who shelled one billion levs to rescue it.

Bivol further found other details which, in addition to BNB, should be interesting for the prosecution and the National Security Agency (DANS). They stem from doubts such as

Draining to Offshore Companies

So far, the scheme suspiciously resembles the one that occurred in KTB – lending to unknown offshore owners, who can be even shareholders of the bank. The loans were not serviced and the arrears were concealed through term renegotiations.

A careful review of the annual accounts of the beneficiaries of loans also indicates something very important. The tree offshore companies standing behind them as owners have received large unsecured loans from their Bulgarian subsidiaries with maturity in 2018 and annual interest of 4.2%. At the same time, the Bulgarian companies accounted for losses.

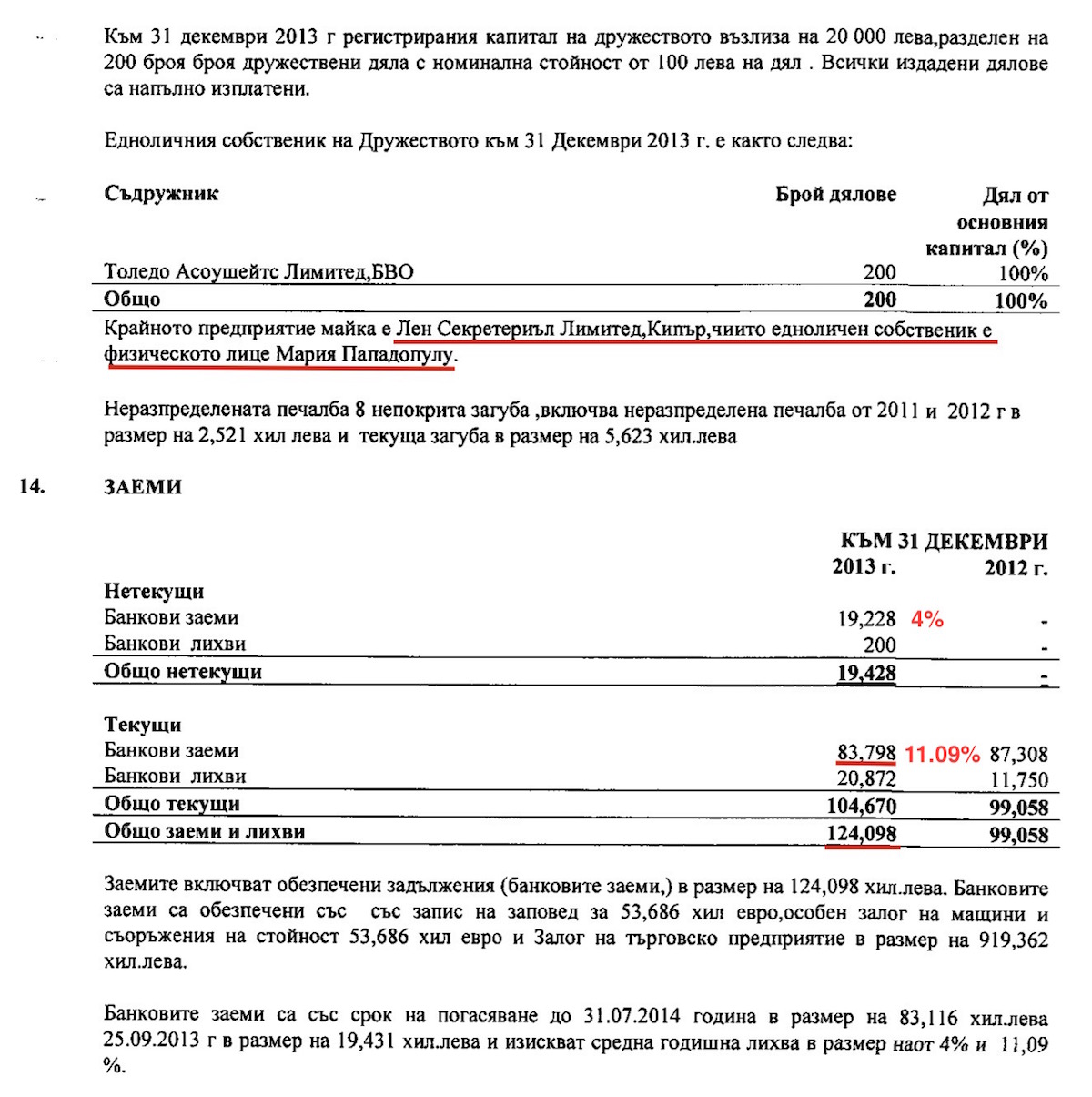

* NADINE METALS TRADE accounted for losses of 5.6 million levs in 2013 and a loan of 19.4 million levs given to its parent company TOLEDO ASSOCIATES LIMITED (Virgin Islands).

* VALPET CONSULT had a loss of 6.8 million levs, but has given a loan to SPIKATA CONSULTING LIMITED (Virgin Islands) of 32.4 million levs.

* ELTRADE had a loss of 20 million levs, but has given a loan of 13.3 million levs to its parent company.

Currently known data shows that 65 million levs have gone quietly to offshore companies in the form of loans. It is unclear why instead of lending, these companies are not repaying their obligations to FIB. There is enough evidence that they are managed by

Parties Connected to FIB

There are plenty of reasons for concern that FIB has violated the law by granting loans to connected parties within the meaning of the Lending Institutions Act. The manager of ELTRADE is Damyan Boyadzhiev, a former loan assessor in FIB. VELPET CONSULT is managed by Peter Tashkov who worked in the Corporate Lending department of the bank. Their main client is NADINE COMMERCE (renamed HEFTY METALS LTD), whose manager, Eftim Stoychev Ormanov, is a long-time employee of FIB and former director of the Liquidity department of the bank.

But that is not all. There are other offshore companies behind the owners of the three companies – the Turkish LEN SECRETARIAL LIMITED for NADINE, NORMAL SECRETARIAL LIMITED for VALPET and DUKE NOMINEES LIMITED for ELTRADE. All three are represented by Lenia Papadopoulou, who also represents the Cypriot offshore LENGANO ENTERPRISES. The latter is a shareholder in FIB with 10 million shares. The same elderly lady is also the Director of Marengo TRADING LIMITED Cyprus and of T.A.K. SERVICES LIMITED in the Virgin Islands, which each have 23% stake in the company YULEN, owner of the ski facilities in Bulgaria’s winter resort of Bansko, as a joint investigation of Bivol and e-vestnik in the ownership in the ski resorts showed.

These are the data that Bivol provided to BNB, but obviously they are not sufficient grounds for a probe in FIB, although Bivol specifically underlined the suspicions of connectivity and asked whether BNB is aware who the offshore owners are? According to the central bank in the loan portfolio of FIB apparently reigns

Harmony

This name is used by several companies registered at 2 “Enos” Street in Sofia. This is the location of the administrative headquarters of FIB. The companies “Harmony” also have offshore owners and are also large borrowers.

HARMONY 2012, owned by HOLDINGS LIMITED (Virgin Islands), is managed by Ivan Elkin, known as “the right hand” of one of the FIB owners, Ivaylo Mutafchiev (agent of the former Communist State Security, DS, with the alias Kamen). It has 19 employees, according to data of the National Social Security Institute. The company received a loan of 4.623 million euro on September 19, 2012. On November 12, 2012 it has received an additional 13 million euro, which is increased with an annex from October 10, 2013 to 20 million euro and with another annex from November 1, 2013 to 30 million euro.

HARMONY 2013, which is owned by Harmony 2012, has only one registered employee, but owns the company KASIS BULGARIA, which has a loan from January 30, 2014 in the amount of 1.55 million euro.

There Are Loans, but No People

One of the main criteria for the activities of a company is the officially registered number of employees who create its product. We cannot miss mentioning this paradox with companies with symbolic staff that are major borrowers of capital from FIB.

FINANCES AND CONSULTING, with owner ROZANKA GROUP LIMITED (Virgin Islands), is also registered at the FIB address – 2 “Enos” Street. It has all together one (1) employee registered in the National Social Security Institute. However, on June 18, 2012, the company received a loan in the amount of 17.5 million euro, and another 3.4 million euro on July 16, 2012. In 2013, the largest borrower-neighbor FINANCES AND CONSULTING in turn reported a loss of 2.7 million levs. And these amounts are managed only by one (1) person?!

In the fall of 2012, HARMONY 2012 and FINANCES CONSULTING competed in the tender for the ferrous metallurgy plant in Kardzhali. Its former owner Vassil Zahariev had amassed an impressive debt of 200 million levs to FIB. The third bidder was the very same FIB. In this simulation of public bid, FINANCES AND CONSULTING offered 8.4 million levs; FIB offered 8.5 million levs and HARMONY 2012 finally won with an offer of 8.6 million levs!

What we are interested in in this case is the fact that the total exposures of these seemingly related to FIB companies, with a total of 20 employees, is 111.5 million levs or 16% of the bank’s capital.

Bivol calculated that if one adds up all the loans to offshore companies suspected of connectivity, they amount to EUR 550 million levs. This is 76% of the bank’s capital, which on September 30, 2014 was 719.6 million levs.

According to Article 45 of the Lending Institutions Act, the total of all exposures of a bank to connected parties may not exceed 20% of its equity.

BNB Fictitiously Promised a Probe and then Backslid

Bivol send the information from this investigation to BNB with specific questions:

– Are the described loans serviced regularly?

– Who are the end owners of the offshore companies that own borrower companies and does BNB know this?

– Is there a request from FIB to BNB for special permission to increase FIB’s exposures to connected parties and if there is, to what connected parties?

– What is BNB’s comment on the renegotiations right before their maturity of this 169 million euro (330 million levs) in loans to the three companies suspected of connectivity to FIB?

A day later, the Head of BNB’s Public Relations Office, Alexander Urumov, replied via email sent to our editorial email address with literally the following: “Thank you for submitting your questions, we will probe this”. Subsequently, he recanted it before other media. This was not followed by an official statement of BNB, but presumably, and according to Urumov’s statement, obviously there will be no probe on the part of BNB. Our central bank demonstrates once again its adequacy to ensure banking security. What remains to be seen is whether this information will alarm someone at the prosecutor’s office and the National Security Agency? The bitter experience from the mass robbery in KTB prejudges the answer. We will inform the European Commission separately.

Bivol’s Comment Bivol – The Seraglios Moved from KTB to FIB

Exposure to connected parties and tricks with FIB’s loans should remind readers of something. The collapse of KTB was also preceded by numerous alarming publications about its huge exposures to connected parties and to fictitious companies, which led to its drain without a reaction of the banking supervision, or it was rather pretending not to notice, as the legal charges against the BNB Head of Banking Supervision, Tsvetan Gunev, have shown.

The depositors and the taxpayers are the victims in this case. The consequences for the economy and our country are tragic. This is a situation very accurately described in the “bad apples” diplomatic cable of former US Ambassador in Sofia, John Beyrle.

“Connected lending continues to be a problem among some banks as their owners funnel money to related – less competitive – companies, with no intention of repaying. This leaves legitimate investors and account-holders holding the bag when bad loans go uncollected.”

Bivol was the first one to publish this report in 2011. We stated then that instead of cleaning the bad apples, the State is sugarcoating them with public money. KTB was for a long time the pet project of those in power in Bulgaria and they poured into it the money of State enterprises. The bank in turn financed the mainstream media of Delyan Peevski’s family which in turn served the power. This “honeymoon” ended with the conflict between the “Seraglios” represented by Peevski and KTB’s majority shareholder, banker Tsvetan Vasilev, who fell in disgrace.

However, “Dogan’s Seraglios” (Ahmed Dogan is the lifetime honorary Chairman of the party of the Turkish minority, Movement for Rights and Freedoms, DPS, known as the most powerful “puppeteer” of the transition period, while shady media mogul and DPS lawmaker Delyan Peevski is believed to be his frontman – editor’s note) cannot remain without a bank and without State aid. As genuine worms they nibbled away the money in KTB and moved to FIB, which has now become the new darling of power.

This was demonstrated by the fact that during the liquidity crisis in June, all relevant protagonists in the country kept repeating that FIB had no systematic capital problem. This mantra is being repeated in a trance now as well – that the problem will be fixed by just giving the banks lots of money and that it would return them even at a profit. Cliché! Money was poured and likely more will be poured, while the capital problem may be disguised through the refinancing of “bad” loans.

The situation is absurd, but logical. Bankers, who by law have no right to manage banks, will secure and conceal the dirty business of the group “10 Seraglios” with money from taxpayers. This colossal public crime is already underway with the blessing of the government of Boyko Borisov, also known as Buddha (his alleged codename as informant of the unit for combatting organized crime in the 90s of the 20th century – editor’s note), and on the backdrop of lamentations of his partner in the government –the right-wing Reformist Bloc – for ending the corrupt model of backstage rule of the country. The backstage ruler, however, simply mutated and started the bloodsucking of a new, yet untouchable, cash donor.

***

If you find this article useful, support our work with a small donation.

Pay a Bivol Tax!

We will highly appreciate if you decide to support us with monthly donations keeping the option Monthly

IBAN: BG27 ESPY 4004 0065 0626 02

BIC: ESPYBGS1

Титуляр/Account Holder: Bivol EOOD

- Powerful US Lobbyist Aids Businesses Linked to Sanctioned Bulgarian Lawmaker, Has Joint Company with Notorious Attorney - 8 January 2022

- Interview for FAKTI.bg

Assen Yordanov: If a lustration law had been passed, Bulgaria would not be in this state

- 19 November 2021 - After Peevski, the Magnitsky Act must target his puppeteers. #LUSTRATION is crucial! - 8 June 2021

This post is also available in: Bulgarian

You must be logged in to post a comment.